KITAMURA HOLDINGS Co.,Ltd.

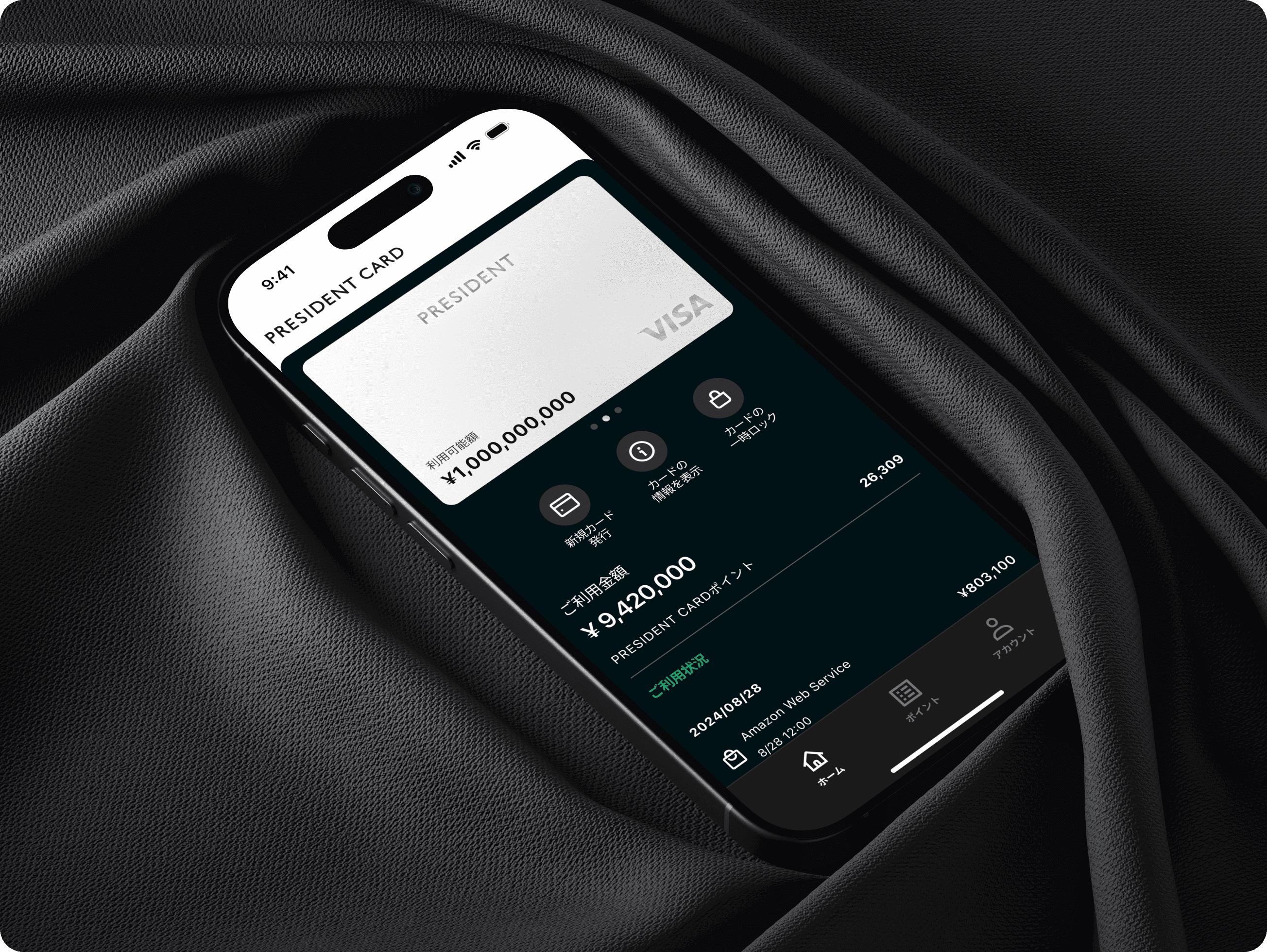

Senior Executive Officer/Chief Financial Office Keiji Nishio

We aim to create a cashless, operation-free world by distributing one card per employee and transitioning to card-based expense settlements. By eliminating petty cash and reimbursements for executives and staff, we seek to reduce the burden and stress for both the administrative and user departments.

Learn More→

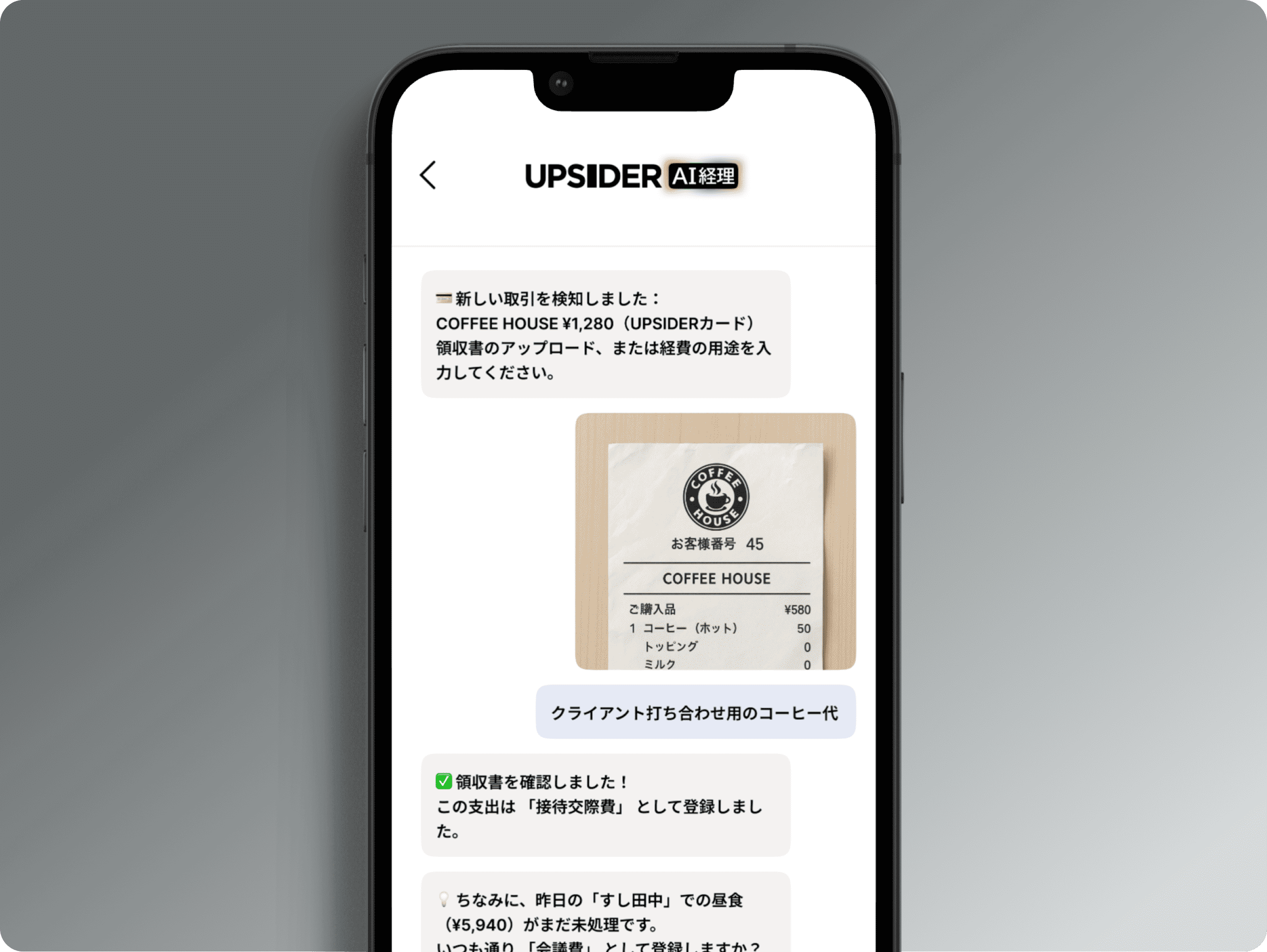

vivid garden Inc.

President and Chief Executive Officer Rina Akimoto

UPSIDER is like a partner in building the business together. Until now, a challenge has been that credit limits often did not increase after procurement. However, UPSIDER responded in just a few days after consultation, truly supporting us in ensuring that our business growth continues. The fact that they flexibly consider the business situation and future potential during the review process is something we really appreciate as a startup.

Learn More→

![[Notice] Some customers of “payment.com”, a billing card payment service, have been affected due to a problem occurring in some credit card systems.](/wp-content/uploads/2024/12/kv_shiharai.jpg)